who pays sales tax when selling a car privately in ny

Register and title the vehicle or trailer. Traditionally the buyer of a car is the one concerned about paying taxes.

281 State Street Albany Ny 12210 Trulia

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

. The dealer must provide the buyer with odometer and salvage disclosure statements. The buyer will have to pay the sales tax when they get the car registered under their name. If youre buying a car from a private seller youll have to pay sales tax.

The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document. The sales tax applies to transfers of title or possession through retail sales by registered dealers or lessors while doing business. Sign the bill of sale even if it is a gift pay sales tax or have proof of an exemption.

Complete and sign the transfer ownership section of the title certificate and. Ad High-Quality Reliable Private Selling A Car Developed by Lawyers. You would not have to report this to the IRS.

Its added to the initial cost of registration. Unless its part of negotiations the buyer will be required to pay all applicable fees and taxes to local authorities. This Ny Times Interactive Compares Renting Vs Buying A Home We Buy Houses Real Estate Sell Your House Fast.

Sign a bill of sale even if it is a gift or. After the title is transferred the seller must remove the license plate from the vehicle. For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply.

Government Grants For Small Business Small Business Grants. Box 68597 Harrisburg PA 17106-8597. Create on Any Device.

The bill of sale must indicate whether the vehicle is new used reconstructed rebuilt salvage or originally not manufactured to US. Who pays sales tax when selling a car privately in ny Sunday August 21 2022 Edit. Consequently who pays sales tax when selling a car.

Vehicles which are gifts are exempt from sales tax. When a person buys a car from someone who is not a car dealer the private. Custom Free Bill Of Sale On A Car Available on All Devices.

Toyota of Naperville says these county taxes are far less and tend to range from 025 - 075. This is because the IRS considers selling a used car for less than you paid a capital loss. Ad Free Fill-In Bill of Sale Templates.

Legal Forms Ready in Minutes. So if you bought the car for 14000 and sold it for 8000 you would have a capitol loss of 6000. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

However if you bought it for 14000 and sold it for 15000 earning a 1000 capital gain you would report this on your tax return using Schedule D on Form 1040 thats appropriately titled. Do not let a buyer tell you that you are supposed to pay the sales tax. If you buy a 1-year used model from a dealership for 14000 and the tax rate is 7 youll end up paying 980 in sales tax which is nearly 600 more than if you bought one through a private party.

The dealer must reveal on the sales contract when a passenger car had been used primarily as a fleet car. This sales tax is incorporated in your cars registration. Provide other acceptable proofs of ownership and transfer of ownership.

The license plate should be returned to PennDOT at Bureau of Motor Vehicles Return Tag Unit PO. The seller paid sales tax when they bought the car so they only pay income tax on the capital gain which is higher if they depreciated. If the sales or use tax is not paid on time the buyer will have to pay interest and penalties.

Edit Download Instantly. If the sale is made by a motor vehicle or trailer dealer or lessor who is registered the sales tax rate is 625. The buyer pays sales tax on the purchase price of the car.

Per the Daily Herald if you live inside the city of Chicago you will be charged an additional city sales tax of 125. Do not let a buyer tell you that you are supposed to. If possible you should consider a private sale as.

When a vehicle is sold in a private sale both the buyer and the seller must fill out a Statement of Transaction form DTF-802 which is then submitted to the New York DMV where the sales tax is calculated and collected from the buyer. Browse Our Wide Selection of Easy Do-It-Yourself Legal Forms and Contracts. But this sales tax doesnt go to the seller it goes to the DMV.

The buyer will have to pay the sales tax when they get the car registered under their name.

New York Vehicle Sales Tax Fees Calculator

New York Vehicle Sales Tax Fees Calculator

New York Vehicle Sales Tax Fees Calculator

1831 Madison Avenue 4m In South Harlem Manhattan Streeteasy

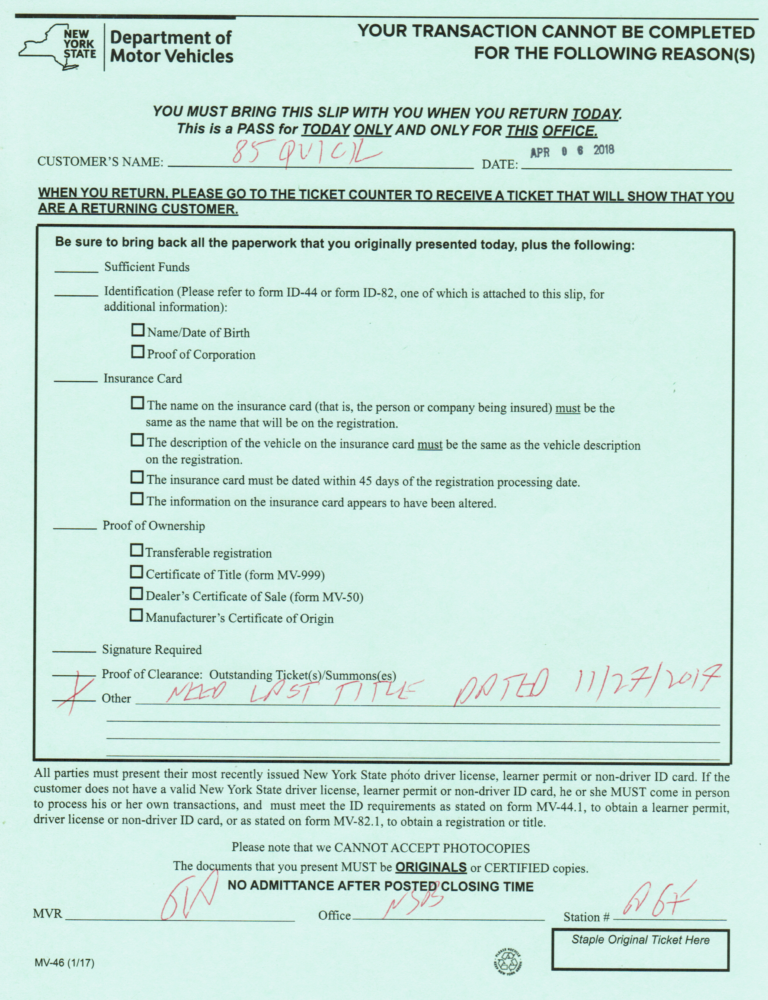

How To Buy A Car From A Private Seller In New York State 85quick Dmv Services

Delta Steps Up Pressure On Employees To Get Vaccinated The New York Times

New York Vehicle Sales Tax Fees Calculator

New York Vehicle Sales Tax Fees Calculator

New York Vehicle Sales Tax Fees Calculator

How To Buy A Car From A Private Seller In New York State 85quick Dmv Services

115 38 142nd St Jamaica Ny 11436 Realtor Com

What Is The Real Cost Of Living In New York City 2022 Bungalow

Delta Steps Up Pressure On Employees To Get Vaccinated The New York Times